In 1998 when I first started in business, the very first thing that I did was buy a stand alone copy of QuickBooks for Business. I think it was around $400 back then and a huge expense for a startup company. But I knew I “needed” it because everyone was using it. I got it all installed on my Dell Optiplex computer (running Windows NT 4.0) and then proceeded to press the “Setup A New Company” button and dutifully go about the process of creating a chart of accounts, adding my banking and credit card accounts, learning to work my banking transactions into my routine, and finally, trying to run my first P&L statement.

And that’s where the confusion started…

I selected the reports tab, and was instantly overwhelmed by the sheer volume of reports that were available. And this was in 1998!

Was I supposed to use cash or accrual accounting? Did I need a regular P&L or a Summary P&L? What did the information on a Balance Sheet mean? How was I supposed to use a Statement of Cash Flows? What level of detail was important?

I was lost.

So I did the same thing that most of my clients do. Before they start working with me, that is…

…I faked it.

And in doing so I just got myself lost deeper and deeper into the QuickBooks matrix. I was running reports all of the time; the end of the month, five days into the month, weekly, bi-weekly, anytime I needed validation or was afraid. And I was constantly being either horrified by the bottom-line or completely stunned to see that I had “made so much money.” While I regularly ran reports and looked at them, it never seemed like I had a handle on how my business was actually doing. My reports were NEVER accurate and I didn’t know why!

This went on for years.

Even as a successful business coach I never really knew how my business was doing financially. I just kept moving forward with my head down, and I encouraged my clients to do the same.

“It will all be fine,” I would tell them. “Finances work themselves out if you just work hard”. But I never really was able to get my clients to truly understand and take control of their finances in a way that was helpful and meaningful to their business and personal success.

And then I met Tina.

I had met accountants before. I had hired many of them to help both my clients and myself, but Tina was different. A 44-year-old German woman with short gray hair, horn rimmed glasses, a no-nonsense attitude (and the mouth of a very polite, very accurate sailor); I could feel that Tina was special. She didn’t just DO BOOKS, or DO TAXES. She really helped my clients understand their finances in a way that wasn’t confusing or threatening in any way. She made it seem so EASY and over the past many years of working together Tina and I documented this ease into a Financial Reporting Process that is now standard for all of my coaching clients.

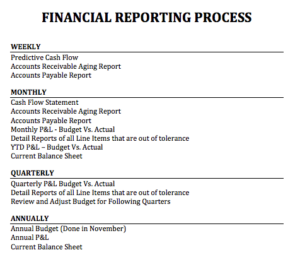

I alluded to my process in Issue #1, but here it is again incase you don’t have that issue in front of you:

Although I’ll take some credit for standardizing this process, I should probably call it something like “Tina’s No Bullsh*t Financial Reporting Process for Dummies.” She just makes this stuff simple to understand and over the past 20 years she’s been the only accountant that I’ve seen do it this way. Most of the accountants and bookkeepers that I’ve worked with seem to know what THEY are doing, but they have a super hard time helping my CLIENTS understand their finances.

Through the creation and implementation of this process, Tina helps my clients (and me) sift through the complicated maze of financial reports and boil it down to ONLY the reports that really help my clients understand their businesses. No fluff (Tina hates fluff), no confusing terminology (English is Tina’s second language after all) – just a simple, repeatable process that helps my clients receive the information that they need to make decisions on a pre-determined schedule that insures the accuracy and “actionability” of the numbers. Let’s go through it step-by-step:

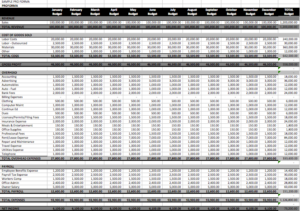

Create your Annual Budget – In order to track your goals, you must first set them, and this is where the annual budget comes in. The whole idea here is to set your BOTTOM LINE goal first (Net Profit) and work backwards. It is NOT enough to simply take last year’s actual results and “add 10%”. This is a mistake that many entrepreneurs make…and it’s the reason that their results are often lackluster. The annual budget should have columns BY MONTH across the top, and the CHART OF ACCOUNTS should be reflected in each row. At the end you’ll have something that looks like this:

Once you’ve completed your budget and added it into your QuickBooks file, you’re ready to create a Predictive Cash Flow. The predictive cash flow is a spreadsheet that Tina first showed me, and then I modified for use with my clients. It basically looks very similar to the budget, except that it breaks out the NEXT 8 WEEKS by week and the following SIX MONTHS by month. The purpose of the cash flow spreadsheet is for you to have a weekly snapshot of your income and predicted expenses so that you can make decisions about what to spend on a regular basis. You can find a sample cash flow document here:

http://bit.ly/sbpb_samplecashflow

Each week the Predictive Cash Flow spreadsheet should be updated with ACTUAL numbers from the prior week and PREDICTED numbers for the current week and beyond.

Once you’ve got the Annual Budget entered into QuickBooks and the Predictive Cash Flow spreadsheet set up, the Financial Reporting Process is quite simple and is repeated on a regular basis with the following schedule.

Weekly Financial Review

– Each week, preferably on a Monday, you and your bookkeeper should review the following documents:

Predictive Cash Flow

Your bookkeeper or assistant should prepare this document ahead of time with the actual bank DEPOSITS and WITHDRAWALS from the prior week and predicted deposits and withdrawals for the following weeks and months. Your goal in this meeting is to make decisions regarding expenses in the following weeks keeping in mind your goal to ensure that there is enough cash flow each week to cover all expected withdrawals and increase free cash flow.

Accounts Receivable Aging

You and your bookkeeper or assistant will review the A/R report to determine:

Who owes you money

Who will be in charge of collecting that money

When that money should be expected

Accounts Payable Aging – In a similar fashion, you will review the A/P Aging report to determine:

Who do you owe money

When will you pay that money

When you have completed this meeting, your bookkeeper or assistant should make all agreed upon updates and submit the updated documents to you for review. I typically recommend that this happen in the SAME BUSINESS DAY as the meeting to ensure that the work gets scheduled and/or completed.

Monthly Financial Review – The monthly financial review is the most important financial meeting that you have each month. The purpose of the monthly financial review is to review the results from the prior month, identify any areas for improvement and develop an action plan for making those improvements in the following weeks. The agenda for the Monthly Financial Review is as follows:

Complete your normal Weekly Financial Review Meeting

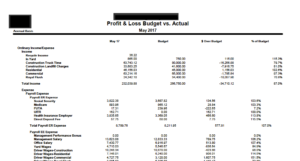

Have your bookkeeper or assistant prepare a Monthly P&L Statement Actual vs. Budget. The report should have 4 columns:

Actual

Budget

$ Over Budget

% of Budget

It will look something like this:

Your bookkeeper or assistant should print out a DETAIL REPORT for any line item that is over 100% of budget and have these reports available for your review. This is where the rubber meets the road. You will use these detail reports to begin the research process and to help you create an action plan to get your over-budget items into tolerance in the next few weeks.

Once you have reviewed the Monthly P&L Budget vs. Actual, you will then review the YTD P&L Budget vs. Actual. This will help you measure your annual progress vs. your budgeted goals.

Each month you will also review the Current Balance Sheet. The balance sheet is a snapshot representing the state of your company’s finances at a moment in time. A number of ratios can be derived from the balance sheet, helping you get a sense of the health of your company. These include the debt-to-equity ratio and the acid-test ratio, along with many others.

At the end of this meeting you will assign actions to all line items that are out of tolerance and begin the process of fixing the expense overages.

Quarterly Financial Review – While you are consistently reviewing your finances each week and month, it’s one a quarterly basis that we make any major changes or budget updates. The purpose of the Quarterly Financial Review is primarily to review and make adjustments to the budget for the following quarters. Here is the agenda for the Quarterly Financial Review:

Complete your normal Monthly Financial Review

Review a Quarterly P&L Budget vs. Actual in the same fashion that you reviewed the Monthly P&L Budget vs. Actual.

Determine which line items in your budget need to be adjusted moving forward. For example, if you budgeted $750 each month for meals and entertainment, but find at the end of Q1 that you’re actually really spending $1500 per month, it would be wise to adjust the budget to reflect the more accurate number.

Have your bookkeeper or assistant make the changes in your budget for the remainder of the year. There is no need to make the changes retroactively to the prior months as those months have already been closed.

So let’s review Tina the German’s No Bulsh*t Financial Reporting Process:

Annual Financial Plan

Create Budget

Create Predictive Cash Flow spreadsheet

Weekly Financial Review

Review Predictive Cash Flow and plan expenses

Review Accounts Receivable Aging and plan collections

Review Accounts Payable Aging and plan payments

Monthly Financial Review

Complete Weekly Financial Review

Review Monthly P&L Budget Vs. Actual

Print detail reports of all items that are out of tolerance

Create action steps to get all out of tolerance line items back on track

Review YTD P&L Budget vs. Actual

Review Current Balance Sheet

Quarterly Financial Review

Complete Monthly Financial Review

Review Quarterly P&L Budget Vs. Actual

Review and adjust budget for the following quarters

That’s it! I know it sounds like a lot and uses some pretty technical terms, but I promise you that if you follow this method, you’ll have a pretty bulletproof process for managing your company’s finance with just one meeting per week, plus one per month, plus one per quarter….and Tina will be very happy ☺

0 Comments